Q4 2023 Commentary and Portfolio Changes

Key Takeaways:

- We are changing our allocations to slightly overweight U.S. quality stocks, seeking to capitalize on the recent market pullback and position for potential upside surprises in U.S. economic growth and corporate earnings.

- We are leaning into U.S. high-quality stocks expressing a high-conviction preference for the largest cap stocks in the U.S. that appear to have attractive growth profiles.

- We plan to decrease our exposure to Europe, moving underweight international Developed Market (DM) stocks due to weakening corporate earnings signals and more pronounced downside vulnerability to potential rising energy prices and geopolitical turmoil.

- We are underweight bonds and overweight cash and short-term instruments that offer very attractive yields.

The ghost of September's past haunted markets once again in 2023 and has carried over. This notoriously weak seasonal period - combined with rising rates and declining liquidity - saw stock and bond prices press lower. The S&P 500 Index, for example, is off its late summer highs by almost 10%, and the Bloomberg U.S. Aggregate Bond Index is down a similar amount from its earlier highs. We are potentially facing an unprecedented third year in a row of bond market losses.

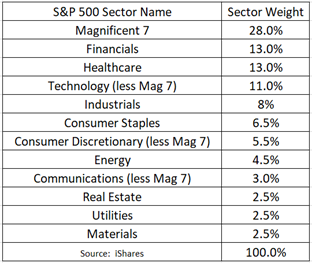

Overall, it has been a challenging year for investors with only the largest stocks doing well while most equity and fixed-income styles are flat to down. The “Magnificent 7” stocks in the S&P 500 (Microsoft, Apple, Nvidia, Meta, Amazon, Google, and Tesla) have driven nearly all of the returns for the S&P 500 this year, so the gains have been very narrow.

The Magnificent 7 represents approximately 28% of the S&P 500 (see the table below). Year to date through 10/25/23, the S&P 500 is up approximately 10.5% but flat to negative if you take out the Magnificent 7. These large-cap technology stocks which were the darlings of the market through the beginning of August, have been turning over in the last few months and are dragging down the overall markets.

Even though many have recently beaten their revenue and earnings projections, they have lowered their forecasts for next year, partially blaming the war in Israel. The Dow Jones Industrial Average of 30 stocks (mostly value-oriented stocks) is up only 2.6%, and the Russell 2000 Index of small company stocks is down approximately 5% so far this year. Bonds have been no refuge again this year with the Bloomberg US Aggregate Index down approximately 2.9%.

However, we believe the recent pullback in large, quality-oriented stocks has created opportunity, supported by growing strength in U.S. economic activity that may prove less fragile than many suspect. Many non-tech U.S. corporate earnings have surprised to the upside and analyst earnings estimates have steadily been revised higher since July in these sectors.

Both time-tested signals have been predictive leading indicators to future stock returns. Fed GDPNow growth estimates in the U.S. have also blossomed higher, doubling from an average of 2.5% through midyear, to an average of 5% since.

Reinvigorated growth expectations are also the likely culprit for the latest leg higher in real interest rates (and less so expectations for higher inflation). As this distinction becomes more apparent to investors, the repricing of this phenomenon could especially benefit U.S. quality stocks, with the most pronounced effect in large-cap stocks.

Further fuel to the U.S. quality stock overweight could also come from a potentially underappreciated source - the Federal Reserve. While such moves are not our base case, we believe there’s more upside than downside risk to changes in Fed temperament.

The “higher for longer” theme appears to be a consensus opinion among investors. But with easing supply chain constraints pushing inflation lower and growing geopolitical strife amidst a coming election year, the Fed may be more sensitive to shifts in sentiment and any whiffs of weakness in the jobs market.

The Fed has multiple levers at its disposal that could reignite positive sentiment – without having to resort to cutting rates. More encouraging forward guidance, alongside the possibility of slowing or even ending Quantitative Tightening, could deliver the next leg higher for the overall market in the next 12 -18 months.

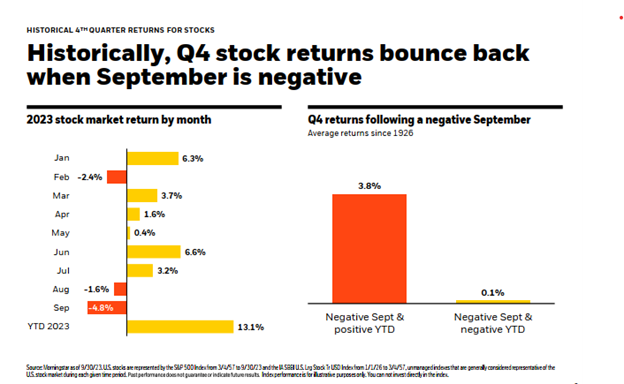

Since 1926, a negative September and a positive overall market return through the end of September have led to a positive 4th quarter uptick by approximately 3.8% on average. In contrast, a negative September, and a negative year-to-date market return for the same period have only averaged a .1% average return (see graph below). We think some of the negative headline news could wane in the coming weeks and offer some more clarity into what the Fed may do by the end of the year.

Our cautious bullishness is mostly contained to U.S. high quality large cap stocks. As such, we plan to be modestly overweighted these types of areas and we are reducing our exposure in international markets based on the turmoil oversees that will impact many companies’ earnings and profitability for the foreseeable future. We are also lowering our weighting to longer term bonds in favor of short-term instruments and cash that has a very attractive yields to give us some dry powder to take advantage of upcoming opportunities. You will likely notice rebalancing trades in your accounts associated with this repositioning.

As always, we appreciate your confidence in our team and look forward to working with you as we approach the new year. Should you have any questions about your individual portfolio, please don’t hesitate to reach out to one of our team members or your advisor.

Virteom

Virteom