Harness the Superpower of Compounding While Reducing “Tax Drag”

By Chad Roope, CFA ®, Chief Investment Officer

By Chad Roope, CFA ®, Chief Investment Officer

Compounding is the superpower of investing. Following the Rule of 70, an investment averaging 10% per year will double in just seven years. That’s the kind of growth that builds real wealth over time.

But there’s a catch. Anything that slows compounding, even slightly, can have a dramatic impact on your long-term results. One of the biggest threats to that is unnecessary taxes.

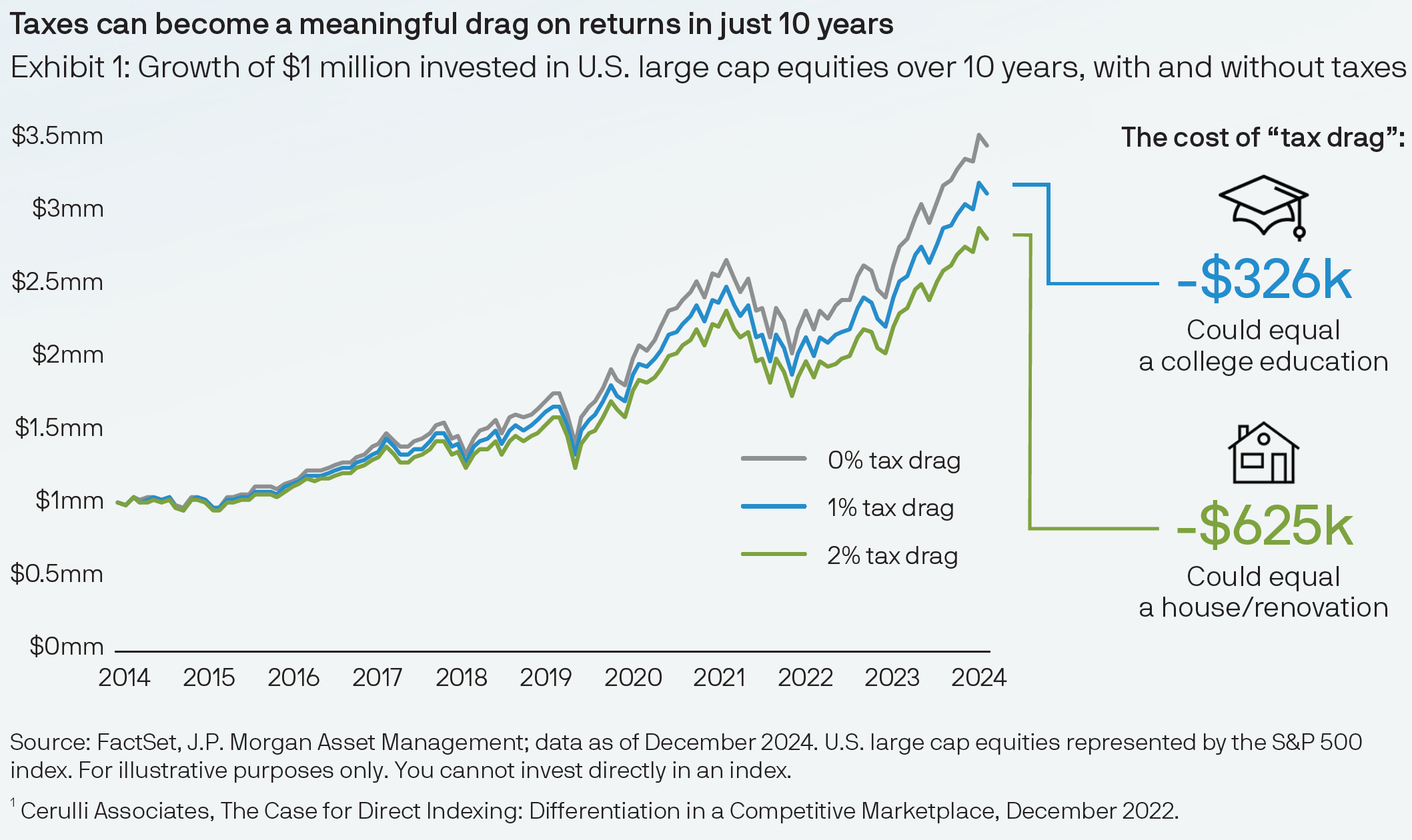

In the chart below, a JP Morgan analysis shows that a modest 1% annual “tax drag” on a $1 million investment in the U.S. stock market from 2014 to 2024 would have reduced its value by $326,000. At 2%, the loss jumps to $625,000. That’s money that could have been working for you.

We all must pay our fair share of taxes. However, we should be very mindful about not paying extra. At Lineweaver, we employ proven, proactive strategies to help reduce unnecessary taxes so you can keep more of your gains compounding year after year.

- Systematic Tax Loss Harvesting

Throughout the course of the year, some investments rise while others fall. That’s diversification for you. But we can help with taxes and get the benefits of diversification at the same time. For example, if a particular company hits a rough patch and we have a loss in the stock in a taxable account, we can sell the stock and harvest the loss to help with taxes. We can then reinvest the proceeds in a different company that we either like better or can serve as a place holder until we can trade back to the original company after the 30-day IRS wash sale rule. We use this approach with many of our clients to help manage taxes without sacrificing portfolio balance. - Municipal Bonds

We often see high-income earners unknowingly leaving thousands on the table when they first come to us due to the fact that they are holding too much cash in taxable CDs and money market funds. Those instruments produce ordinary income that’s taxed at some of the highest rates, quietly siphoning away your returns year after year. However, with the right strategy such as targeted municipal bond investments, we’ve helped many clients earn equal or better yields after taxes while keeping far more of their money working for them. - Asset Location

Some investors unknowingly sabotage their own returns simply by putting the wrong investments in the wrong accounts. For example, a corporate bond may be a great investment, but it pays income that is taxed as ordinary income. If you’re holding them in a taxable account, you could be handing over far more to the IRS than necessary. For our clients, we help try to avoid this costly mistake by using asset location and strategically placing investments like corporate bonds in IRAs or other tax-qualified accounts. Done right, this can mean keeping more of your income compounding year after year. - Gifting

Many people give generously to charity, but we see many people missing out on huge tax savings in the process. If you’re donating cash, you could be leaving money on the table. Instead, we help build strategies like gifting highly appreciated stock from a taxable account or directing your required minimum distribution from an IRA. These options can deliver the same support to your favorite cause while reducing your tax bill. This approach not only preserves more of your wealth, it also eliminates capital gains on appreciated stock or income taxes on your RMD. If you’re not using these strategies, you’re not just giving to charity, you might be giving extra to the IRS, too. - Concentrated Stock Positions

Executives of public companies often have large positions in company stock. Without a strategy, a sudden market shift or tax hit could wipe out years of gains. We help clients protect and grow their wealth by using tax-smart techniques like charitable giving strategies, custom-built portfolios that harvest losses and move differently than concentrated positions, and careful optimization of stock options and grants within the right tax bracket. If you’re not managing your company stock this way, you could be gambling with both your portfolio and your tax bill. - Roth Conversions

Many investors unknowingly set themselves up for a massive tax bill in retirement by leaving too much in Traditional IRAs, where every withdrawal is taxed as ordinary income. One of the most powerful ways to avoid this is through strategic Roth conversions, turning taxable retirement money into tax-free income for life. We work closely with our tax department to calculate exactly how much to convert each year to maximize long-term savings and help prevent our clients from locking themselves into higher taxes for the rest of their retirement.

These strategies, paired with the coordination of our advisors, tax department, and investment team, help our clients minimize “tax drag” and fully harness the power of compounding interest. This is a cornerstone of how we manage investment portfolios at Lineweaver and it could be the key to helping your wealth grow faster. If there’s a strategy here that you’d like to discuss further with an advisor, reach out today to schedule your one-on-one meeting.

Source: JP Morgan “Tax Smart Investing”

Virteom

Virteom